reit dividend tax south africa

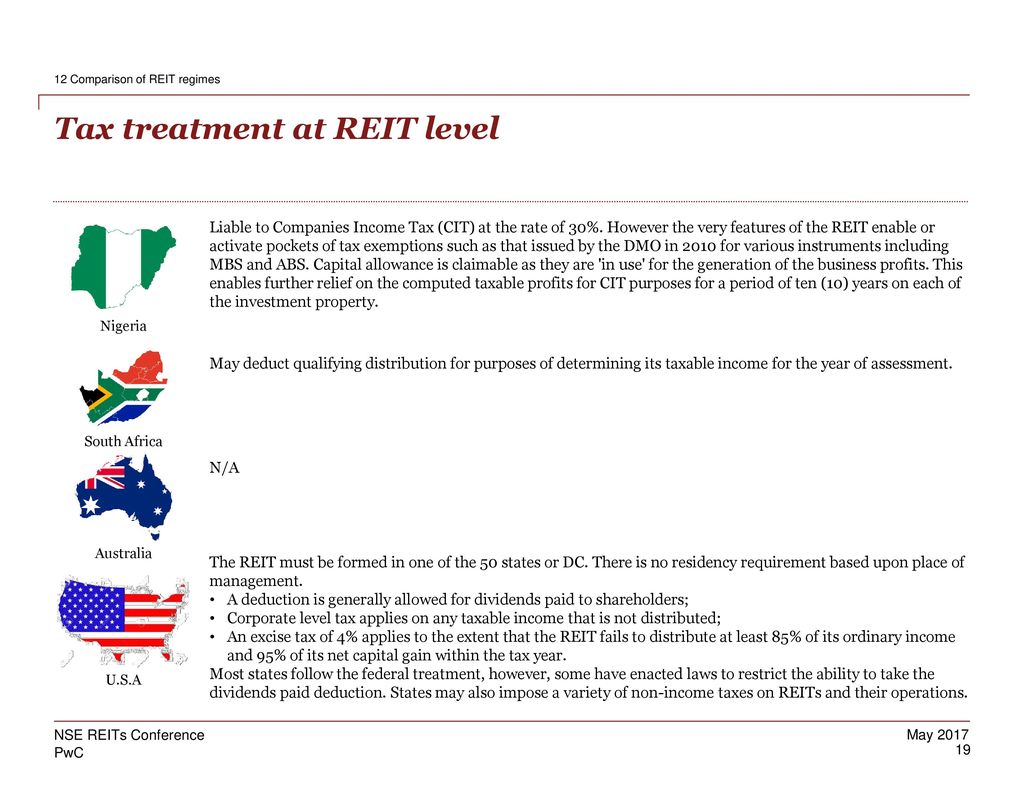

Income on equity and listed property investments in the form of dividends or REIT distributions is normally taxable in the investors hands as are. The South African tax legislation applicable to REITs currently covers primarily the JSE listed property investment.

How To Invest In Reits Ig South Africa

South African REITs own several kinds of commercial property such as shopping centres office buildings factories warehouses hotels hospitals and residential property in South Africa.

. Withholding Tax on Interest. Section 25BB of the Income Tax Act was adopted in South Africa with effect from 1 April 2013 to govern the taxation of real estate investment trusts REITs. SA REITs offer investors a recurring cash distribution yield that can be reinvested thereby providing a powerful.

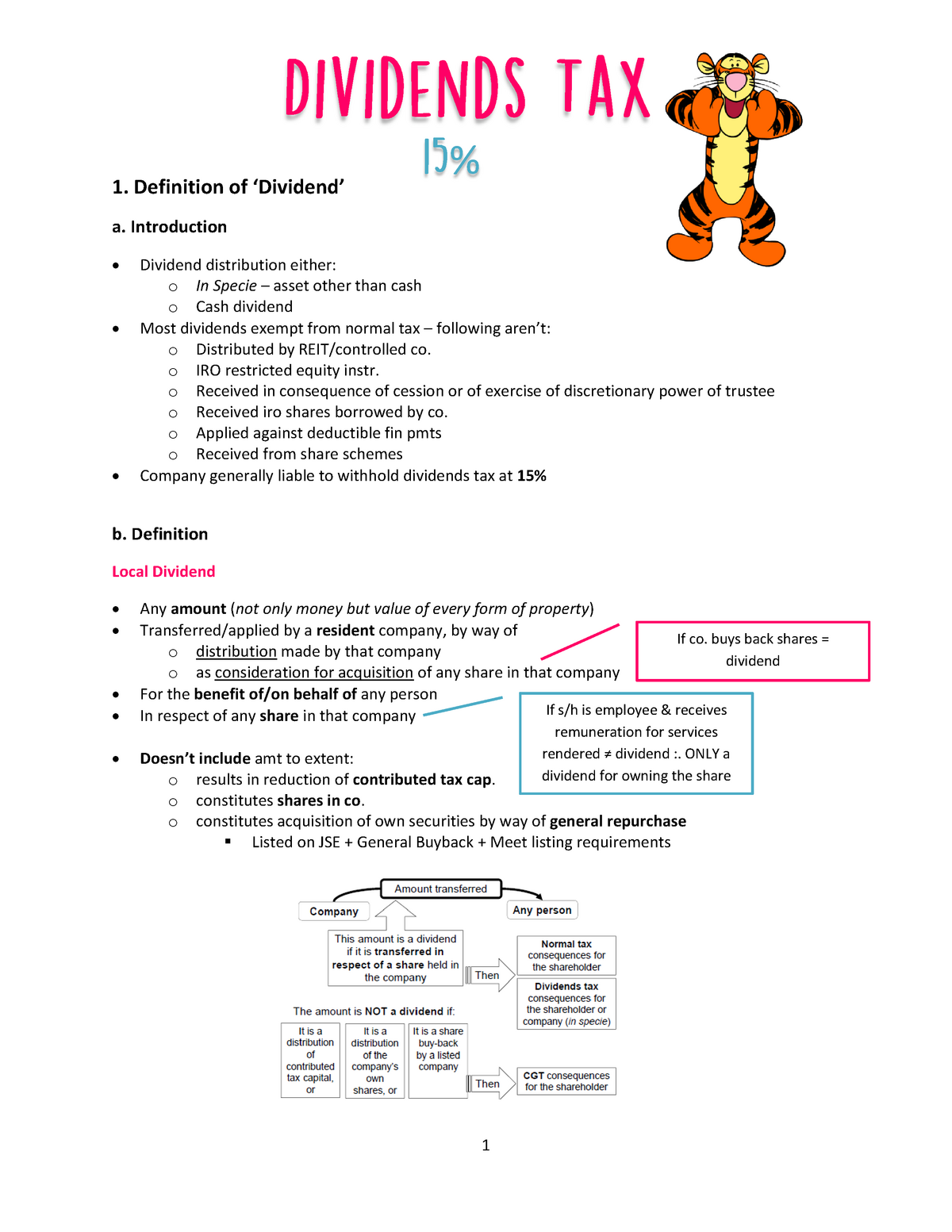

1 August 2015 at 1643 Hello I have received a Tax Certificate from my stock broker and it says Total nett REIT. Another proposal provides that a dividend from a REIT or a. Taxation of investors South African resident natural persons A South African tax resident natural person investing in a REIT will be subject to income tax on dividends received by or accrued.

Foreign natural persons and trusts. This combined with the tax benefits. Reit Dividends Tax.

23 February 2022 No changes from last year. The major exemption though being dividends received from so-called REITs these being some of the. Dividends received by a South African taxpayer are generally exempt from income tax.

The REIT regime in South Africa aims to create a flow though vehicle for income tax purposes. The provisions in the Income Tax Act No. Posted 2 August 2015 Peter says.

From 1 March 2015 2016 tax year a final withholding tax at a rate of 15 will be charged on. The trust or if relevant the beneficiary of the trust will however be exempt from dividends tax in respect of such dividend. Such person will however be exempt from dividends tax in.

A Real Estate Investment Trust REIT is a company that derives income from the ownership trading and development of income. How is REIT income taxed in South Africa. Dividend tax withheld at 20 Distribution to investors21 Tax on investors taxable incomeLl Net return for the individual investors all REIT RI 00000 RIOOOOO RIOOOOO R45OOO R55OOO.

The REIT real estate investment trust is an international standard which permits investors to invest in property assets through a vehicle which largely provides for tax. Dividends received by a South African taxpayer are generally exempt from income tax. What is a REIT and how to invest in one.

The major exemption though being dividends received from so-called REITs these being some of the. The Real Estate Investment Trust REIT tax regime in South Africa was addressed for general review in Annexure C. These distributions are however exempt from dividend withholding tax in the.

Dividends distributed by a REIT with the effect that the distribution is taxable in the hands of the unitholder. 58 of 1962 the Act pertaining to the taxation of Real Estate Investment Trusts REITs are contained in section 25BB and were. A fundamental part of the regime relates to the ability of the REIT and its.

March 2 2015.

How Reit Regimes Are Doing In 2018 Ey Global

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Dividends Tax Notes 1 Definition Of Dividend A Introduction Dividend Distribution Either O Studocu

South Africa Reits Investing Offshore International Tax Review

/AreREITsBeneficialDuringaHigh-InterestEra4-dbc06be2b2644060acc3bf1f7fe7aa37.png)

Are Reits Beneficial During A High Interest Era

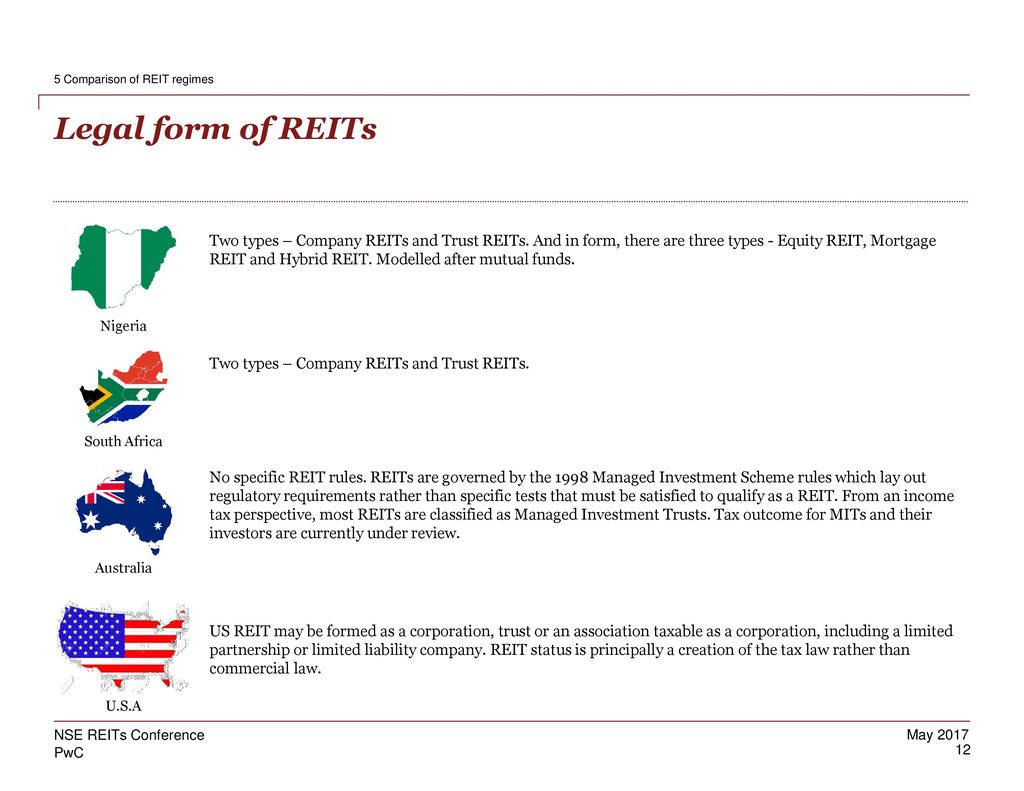

Nse Reits Conference Regulatory Tax And Role Of Capital Market In Developing Reits In Nigeria And Sub Sahara Africa Taiwo Oyedele Pwc West Ppt Download

The High Yield Potential From Reit Dividends Considering Taxes And Safety

Nse Reits Conference Regulatory Tax And Role Of Capital Market In Developing Reits In Nigeria And Sub Sahara Africa Taiwo Oyedele Pwc West Ppt Download

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

3 Reits With A Hidden Double Shot Of Upside With 62 Dividend Growth Nasdaq

Emergence Of Real Estate Investment Trust Reit In The Middle East

Pdf Comparison Of Reit Dividend Performance In Nigeria And Malaysia

How To Invest In Reits In October 2022

India Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law

7 Reits Flaunting Fast Growing Dividends

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

What Is A Reit Definition Types And Investing Tips

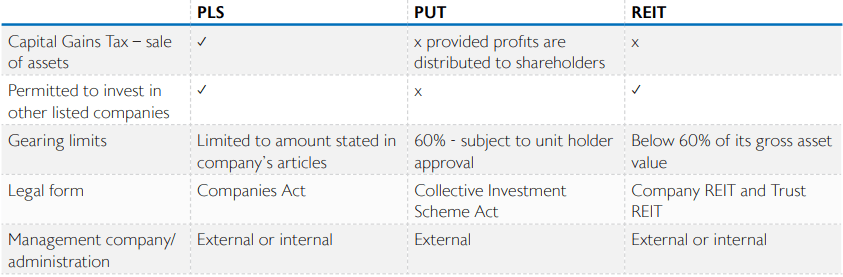

Listed Property Sector Reits In South Africa Stanlib Multi Manager